The Overhaul of NAFTA –A New Free Trade Agreement for North American Agriculture

Whilst preserving existing agricultural commitments between Canada, the US and Mexico, it is hoped that a revamped USMCA will drive increased agricultural trade and new opportunities.

North American agriculture depends on international trade:

- US $140.5 billion = The value of US food & farm products exported in 2017

- US $127 = Every US$1 in agricultural exports generates an additional US$127 in economic activity

- 1,000,000+ jobs = The number of jobs US farm exports support, which generate much-needed economic activity across rural America

- US $1 billion = Every UUS$1 bn in farm exports supports 8,000 jobs

- 20%+ = Amount of US farm and food products that are exported

- 4X+ = Increased trade in agriculture and agri-food products in North America over the past 25 years

- USD$48.5 billion = Trade between Canada and the U.S alone in agriculture and agri-food products in 2017

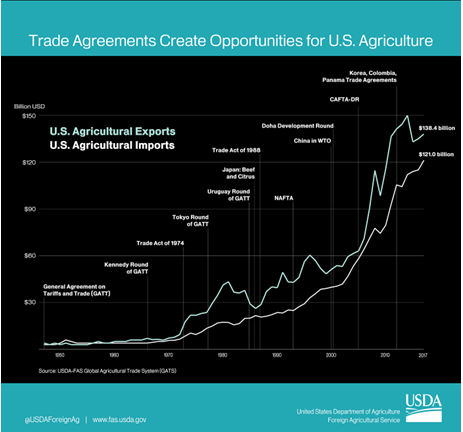

- 90%+ = % of Canadian farmers dependent on exports

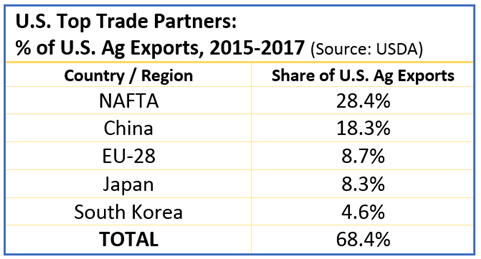

Trade agreements have helped increase agricultural export trade by creating open markets and opportunities for agriculture. The North American Free Trade Agreement (NAFTA) has been an especially important FTA for the US, Canada and Mexico, with one of the largest, most positive impacts on increased agricultural trade for the three countries. For US agriculture, Canada and Mexico are the first and third largest export markets, accounting for more than a quarter (28%) of all US agricultural exports. Since 1 January 1994, when the original NAFTA went into force, the value of US agricultural exports to:

- Canada has increased by 271%

- Mexico has increased by 305%

Negotiations to modernize NAFTA began in August 2017. A revamped trade deal was reached on 30 September 2018 among the three nations which replaces NAFTA— the United States-Mexico-Canada Agreement (USMCA). It should be noted that USMCA’s immediate future is still somewhat uncertain, as the new agreement needs to get final approval and be ratified by the US, Mexico and Canada Governments. As well, there are still some negotiations ongoing to eliminate retaliatory tariffs which USMCA does not provide relief for.

General sentiment on the agricultural side of the agreement is mixed – depending on the specific agricultural product and how that product is or isn’t addressed in the new agreement.

- US Government and trade sentiment is generally positive for USMCA. Why? The USMCA agreement achieves some important objectives for US trade:

- Creates a level of certainty, helping growth of US agricultural exports to be maintained

- Potential for modest improvements in market access for some US products

- Success for this trade negotiation and momentum for ongoing trade agreements (provides time to focus on Japan, China, etc)

“I’m pleased to see the US, Canada, and Mexico have successfully delivered a renegotiated NAFTA for consideration, and I am eager to review the details,” said Senate Agriculture Committee Chairman Pat Roberts, R-Kansas. “This trade pact will provide our farmers and ranchers with much needed export market certainty and will strengthen the relationship with two of our most important trading partners.”

- Mexico’s sentiment appears to be generally positive. Despite some lingering concerns regarding trade restrictions, Mexico largely has welcomed the new USMCA. Why?

- The deal maintains most of the free trade status the three partner countries shared under the old NAFTA

- It helps maintain stability for the Mexican peso, which has been roller coaster-like during the negotiation process

“We celebrate the trilateral agreement. The door is closed to the fragmentation of the region,” Jesus Seade, NAFTA negotiator for Mexico’s president-elect Andres Manuel Lopez Obrador, said. “NAFTA2 will give certainty and stability to Mexican trade with its partners in North America.”

- Canadian agricultural trade appears positive to luke-warm about the new FTA. Some feel that the benefits are modest at best for Canadian agriculture but yet necessary for Canadian agriculture in general. Why?

- While Canadian agri-food exporters have largely benefitted from NAFTA, Canadians agree that there are areas to be improved and modernised

- Canadian agriculture is dependent on exports. In order for agriculture in Canada to succeed, borders need to be open and trade relations must remain strong

- There is some improved access for Canada’s agri-food exports to North American markets in which products such as sugar and certain dairy products may directly benefit

- Yet, it may negatively impact certain agricultural production, for example the Canadian egg industry

Brian Innes, president of the Canadian Agri-Food Trade Alliance (CAFTA), indicated: “We welcome an agreement to renew NAFTA. An agreement is an important step forward for the hundreds of thousands of farmers, ranchers, food manufacturers and agrifood exporters who rely on free and open trade and have felt the impact of continued uncertainty. At first glance, there will be some improved access for Canada’s agri-food exports to North American markets.”

According to Global Affairs Canada, “The United States-Mexico-Canada Agreement (USMCA) will preserve existing agriculture commitments between Canada, the US and Mexico, and help bring together an already highly integrated industry. The agriculture and agri-food sector is a key driver of Canada’s economy, and the USMCA will help Canada reach the Government’s goal of increasing agri-food exports to $75 billion annually by 2025.”

“The outcome of the negotiations will have a negative impact on the system of supply management as a whole and specifically on the vitality of Canada’s egg farming sector. It represents a hit to consumers who overwhelmingly prefer Canadian eggs, with nearly 90 percent agreeing it’s important that the eggs they purchase are produced in Canada,” said Roger Pelissero, Chairman of Egg Farmers of Canada.

Orrani Consulting keeps tabs on the markets as well as the trade agreements which impact them. If your business is in need of a deeper understanding of USMCA or other FTAs and how they might affect your products, reach out to us at Orrani Consulting today.